10 Best Undervalued Stocks to Buy Now According to Billionaire DE Shaw

- Vavio.io

- Sep 24, 2022

- 9 min read

In this article, we shall discuss the 10 best undervalued stocks to buy now according to billionaire D.E. Shaw. To skip our detailed analysis of Shaw's history, his investment philosophy, and hedge fund performance, go directly and see 5 Best Undervalued Stocks to Buy Now According to Billionaire DE Shaw.

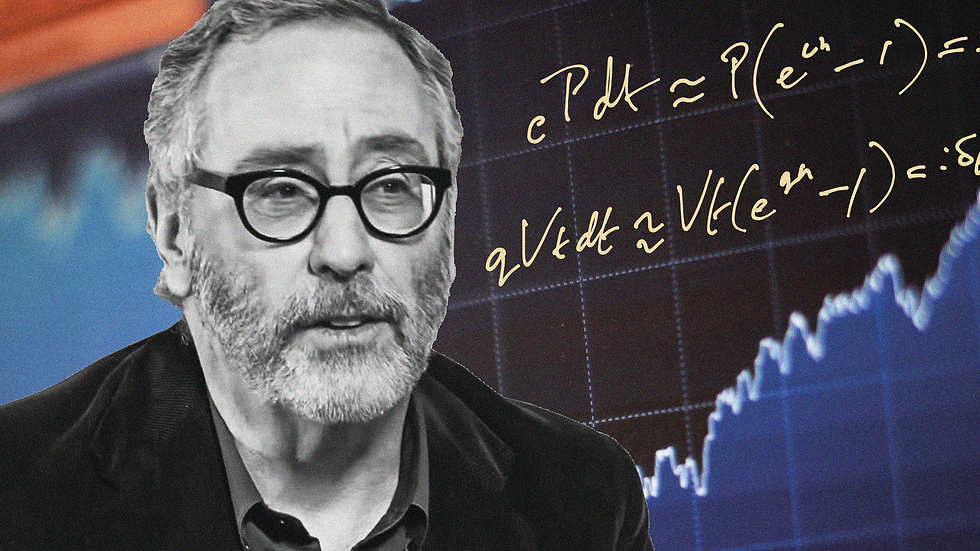

David Elliot Shaw, an American billionaire scientist and former hedge fund manager, graduated summa cum laude from the University of California, San Diego, and earned a PhD from Stanford University in 1980. In 1988, he founded his own hedge fund, D.E Shaw and Co.

As part of his investment strategy, Shaw manages a variety of investment funds that deploy quantitative methods and proprietary computational technology developed by his company over 30 years of research and training, to support fundamental research in the management of his investments. Additionally, his company extensively uses qualitative analysis to make private equity investments in technology, real estate, financial services firms, wind power, and distressed company financing. Shaw aims to identify statistically prospective market inefficiencies through hypothesis formulation, testing, and validation based on practical knowledge of markets and advanced computational techniques. His company is organized in a way where teams work together to trade ideas, identify and address risks, build tools, and explore profitable opportunities. Furthermore, several of the strategies adopted by the firm seek to identify and isolate investment opportunities through a carefully-crafted hybrid approach that combines aspects of systematic and discretionary strategies. David E. Shaw of D.E. ShawDavid E. Shaw of D.E. Shaw As of the second quarter of 2022, D.E. Shaw and Co. has an incredibly diversified portfolio with large investments in the technology, services, healthcare, finance, basic materials, and consumer goods sectors. The fund's Q2 2022 portfolio value stands at more than $85.3 billion for over 6000 holdings, the result of a 0.08% increase as compared to the previous quarter. As of June 1, D.E Shaw has $60 billion in investment and committed capital. The portfolio turnover from Q1 2022 to Q2 2022 was 26.9%. Some of the prominent undervalued stocks to feature in D.E. Shaw's Q2 2022 portfolio are Meta Platforms Inc. (NASDAQ:FB), AT&T Inc. (NYSE:T), and FedEx Corp. (NYSE:FDX). In this article, we shall zoom in on the 10 best undervalued stocks to buy now according to billionaire David E. Shaw.

Our Methodology The undervalued stocks mentioned below have been chosen from D.E. Shaw's 13F investment portfolio from the second quarter of 2022. We checked each stock’s trailing-twelve-month price-to-earnings ratios and narrowed down our selection to the top stocks that had a PE ratio of 15 or less.

Insider Monkey's extensive database tracking 895 hedge funds was used to gauge hedge fund sentiment around each stock.

Best Undervalued Stocks to Buy Now According to Billionaire D.E. Shaw 10. Occidental Petroleum Co. (NYSE:OXY)

D.E. Shaw's Stake Value: $244.9M Percentage of D.E. Shaw's 13F Portfolio: 0.28% Number of Hedge Fund Holdings: 66 PE Ratio (TTM): 6.45

Based in Houston, Texas, Occidental Petroleum (NYSE:OXY) is an American company engaged in hydrocarbon exploration in the United States and the Middle East. It also specializes in petrochemical manufacturing in Canada, the U.S, and Chile. The company ranked 670th on the 2021 Forbes Global 2000. As of the second quarter of 2022, Occidental Petroleum (NYSE:OXY) posted an EPS of $3.16, beating estimates of $3.02 by $0.14. The company posted a total revenue of $10.7 billion in Q2 2022. Like Meta Platforms Inc. (NASDAQ:FB), AT&T Inc. (NYSE:T), and FedEx Corp. (NYSE:FDX), Occidental Petroleum (NYSE:OXY) is one of the best undervalued stocks to buy now according to billionaire D.E Shaw.

Investor interest around Occidental Petroleum (NYSE:OXY) has fallen slightly in Q2 2022, with 66 hedge funds long the stock, compared to 67 in the preceding quarter. As of Q2 2022, Warren Buffett's Berkshire Hathaway is the largest shareholder in the company, owning more than 158.5 million shares valued at $9.3 billion. In the second quarter of 2022, D.E. Shaw owns 4.2 million shares worth more than $244.9 million. Occidental Petroleum (NYSE:OXY) makes up for 0.28% of D.E. Shaw's 13F portfolio.

On September 6, Morgan Stanley analyst Devin McDermott raised the price target on Occidental Petroleum (NYSE:OXY) to $76 from $70, maintaining an Equal Weight rating on the stock. According to the analyst, the recently passed Inflation Reduction Act provides attractive support for low carbon growth growth across CCS and hydrogen. Furthermore, McDermott sees larger integrated companies like Occidental Petroleum (NYSE:OXY) as best positioned to benefit from the Act, which is a viable path to profitably transition towards a lower carbon business mix over time.

Smead Capital Management mentioned Occidental Petroleum (NYSE:OXY) in their Q2 2022 investor letter. This is what they said: “For the quarter, our best-performing stocks were Continental Resources (CLR), Merck (MRK) and Occidental Petroleum Corporation (NYSE:OXY). Despite a steep sell-off in June in the oil and gas stocks, two of our oil stocks made the quarterly list.

If you are wondering how we are outperforming the S&P 500 Index in the first half of the year, look no further than our top three performers. Occidental Petroleum (OXY), Continental Resources (CLR) and Conoco Phillips (COP) soared in value and were barely represented in the S&P 500 Index. To quote Jerry Jones, owner of the Dallas Cowboys, “We are in the first quarter on higher energy prices!” 9. Ford Motor Co. (NYSE:F) D.E. Shaw's Stake Value: $257.6M Percentage of D.E. Shaw's 13F Portfolio: 0.3% Number of Hedge Fund Holdings: 46 PE Ratio (TTM): 5.37

Headquartered in Dearborn, Michigan, Ford Motor Co. (NYSE:F) is an American multinational automobile manufacturer. It is next on Shaw's list of the 10 best undervalued stocks to buy now. The company sells automobiles and commercial vehicles under the Ford brand, and luxury cars under its Lincoln brand. As of the second quarter of 2022, D.E. Shaw has a total stake of $257.6 million in Ford Motor Co. (NYSE:F). A result of Shaw decreasing his hold over the stock by 26%, Ford (NYSE:F) makes up for 0.3% of Shaw's 13F investment portfolio for Q2 2022.

On September 9, BofA analyst John Murphy lowered the price target on Ford Motor Co. (NYSE:F) to $28 from $32, keeping a Buy rating on the stock. Since supply chain issues are likely to pressurize auto volumes in 2023, and the macro environment has become increasingly risky, Murphy expects the next peak in demand in 2028. He is revising estimates and price objectives across all his auto coverages, as he now projects U.S. auto sales to be 13.9 million units in 2022, 15.3 million in 2023, 16 million in 2024 and 16.8 million in 2025, all down from his previous forecasts.

Hedge fund sentiment around Ford Motor Co. (NYSE:F) has remained the same in Q2 2022, with 46 hedge funds long the stock in both, Q1 2022 and Q2 2022. As of the second quarter of 2022, Citadel Investment Group is the largest shareholder in Ford Motor Co. (NYSE:F), owning more than 29 million shares worth at around $323.2 million.

This is what Baron Funds had to say about Ford Motor Co. (NYSE:F) in their Q1 2022 investor letter, a copy of which can be obtained here: “Ford (NYSE:F) is another example of typical industrial manufacturing business executive mindsets. The April 18, 2022, Bloomberg Businessweek cover story features Ford CEO Jim Farley behind the wheel of an electrified Ford F-150 Lightning. The article is titled, “Hey Elon, THIS is a truck.” I thought the article was terrific. One idea especially stood out to me. Since the F-150 is such a popular vehicle, it “argued for a gradual approach to electrification. Essentially the company retrofitted an existing F-150 with an electric powertrain rather than develop an entirely new truck.” No all-in financial and operation bet by this company on electrification.” 8. The Philips 66 Co. (NYSE:PSX) D.E. Shaw's Stake Value: $282.1M Percentage of D.E. Shaw's 13F Portfolio: 0.33% Number of Hedge Fund Holdings: 38 PE Ratio (TTM): 7.59

Based in Westchase, Houston, The Phillips 66 Co. (NYSE:PSX) is an American multinational energy company which specializes in the refining, transporting, and marketing of natural gas liquids and petrochemicals. They also engage in the research and development of emerging energy sources. On July 6, Barclays analyst Theresa Chen raised the price target on The Phillips 66 Co. (NYSE:PSX) to $113 from $95, keeping an Overweight rating on the shares. The analyst raised her Q2 2022 EPS estimate to $6.11, above the consensus of $4.81, mostly driven by a higher refining contribution. Chen's Q2 refining estimate reflects an "extremely strong" crack spread backdrop, 91% utilization, and recovering margin capture. The company is one of the most prominent entries on billionaire D.E Shaw's list of the best undervalued stocks to buy now.

On July 23, The Phillips 66 Co. (NYSE:PSX) posted its Q2 2022 returns, reporting a total revenue of $48.6 billion in Q2 2022. Furthermore, the company generated an operating cash flow of $1.8 billion, with the earnings reflecting the strong market environment during the second quarter, driven by a tight global product supply and demand balance. In the second quarter of 2022, the company posted an EPS of $6.77, beating estimates of $5.97 by $0.8. Hedge fund sentiment around The Phillips 66 Co. (NYSE:PSX) took a hit in Q2 2022, with only 38 hedge funds featuring The Phillips 66 Co. (NYSE:PSX) in their Q2 2022 investment portfolios, compared to 41 in the preceding quarter. As of Q2 2022, D.E. Shaw is the largest shareholder in The Phillips 66 Co. (NYSE:PSX), owning more than 3.4 million shares valued at almost $282.1 million. The result of Shaw increasing his hold over the stock by 56%, the company makes up for 0.33% for Shaw's 13F portfolio.

Like Meta Platforms Inc. (NASDAQ:FB), AT&T Inc. (NYSE:T), FedEx Corp. (NYSE:FDX), Phillips 66 Co. (NYSE:PSX) is one of the most prominent undervalued stocks to feature in D.E Shaw's Q2 2022 investment portfolio. 7. JPMorgan Chase & Co. (NYSE:JPM)

D.E. Shaw's Stake Value: $304.1M Percentage of D.E. Shaw's 13F Portfolio: 0.35% Number of Hedge Fund Holdings: 104 PE Ratio: 9.56

Based in New York City, JPMorgan Chase & Co. (NYSE:JPM) is an American multinational investment bank and financial services holding company which is incorporated in Delaware. As of 2022, JPMorgan Chase & Co. (NYSE:JPM) is the largest bank in the United States, the world's largest bank by total market capitalization and fifth largest bank in the world in terms of total assets, with total assets of almost $4 trillion. As of the second quarter of 2022, the bank reported a total revenue of $30.7 billion. JPMorgan Chase & Co. (NYSE:JPM) also posted an EPS of $2.76 in Q2 2022, trailing behind estimates of $2.88 by $0.12.

Investor interest around JPMorgan Chase & Co. (NYSE:JPM) has fallen in the second quarter of 2022, with 104 hedge funds long the stock, compared to 110 in the preceding quarter. As of Q2 2022, Fisher Asset Management is the largest shareholder in JPMorgan Chase & Co. (NYSE:JPM), having a total stake of $899.7 million. D.E. Shaw and Co. is much more conservative in their ownership of the stock, owning more than 2.7 million shares valued at $304.1 million. A result of Shaw strengthening his hold over JPMorgan Chase & Co.

(NYSE:JPM) by 45%, the company now makes up for 0.35% of Shaw's 13F portfolio.

Carillon Tower Advisers mentioned JPMorgan Chase & Co. (NYSE:JPM) in their Q1 2022 investor letter, a copy of which can be obtained here. This is what they had to say: “More cyclical sectors, including technology and consumer discretionary, were among the weakest, likely due to rising interest rates and inflation. It was encouraging to see the quarter finish on a strong note with the S&P 500 only about 5% away from its all-time highs. Shares of JPMorgan Chase (NYSE:JPM) detracted from performance due to the company’s increased expense guidance, announced in January.” 6. Qualcomm Inc (NASDAQ:QCOM) D.E. Shaw's Stake Value: $355.5M Percentage of D.E. Shaw's 13F Portfolio: 0.41% Number of Hedge Fund Holdings: 71 PE Ratio (TTM): 11.7

Headquartered in San Diego, California, Qualcomm (NASDAQ:QCOM) is an American multinational corporation which specializes in the production of semiconductors, software, and services related to wireless technology. As of September 11, the company has a market capitalization of $148.3 billion, and a price-to-earnings ratio of 11.7. As of Q2 2022, Qualcomm (NASDAQ:QCOM) posted an EPS of $2.96, beating estimates of $2.87 by $0.09. On July 29, DZ Bank analyst Ingo Wermann downgraded Qualcomm (NASDAQ:QCOM) to Hold from Buy, keeping a price target of $150 on the shares. Alongside prominent stocks like Meta Platforms Inc. (NASDAQ:FB), AT&T Inc. (NYSE:T), FedEx Corp. (NYSE:FDX), Qualcomm (NASDAQ:QCOM) is one of the most eminent undervalued stocks to appear in D.E. Shaw's 13F portfolio.

Investor interest around Qualcomm (NASDAQ:QCOM) has decreased in the second quarter of 2022, with 71 hedge funds having a collective stake of more than $2.8 billion. This is down from 73 hedge funds in Q1 2022, which had a total stake value of $3.6 billion in Qualcomm (NASDAQ:QCOM). As of Q2 2022, Citadel Investment Group is the largest stakeholder in the stock, owning more than 5 million shares worth $644.1 million. Shaw does not trail too far behind, owning more than 2.8 million shares valued at $355.5 million. A result of Shaw loosening his grip over the stock by 3% in Q2 2022, Qualcomm (NASDAQ:QCOM) makes up for 0.41% of Shaw's 13F investment portfolio.

This is what ClearBridge Investments had to say about Qualcomm (NASDAQ:QCOM) in their Q4 2021 investor letter, a copy of which can be obtained here:

“Market strength continued in the fourth quarter, with only the communication services sector down in the Russell 1000 Value Index. Portfolio returns benefited from the strong performance of semiconductor maker Qualcomm, which has executed exceptionally well in pursuing the transition to 5G, growing both content and share due to its leadership position in cellular technology. The chipmaker recently outlined a number of peripheral growth opportunities outside of mobile markets, including automotive (where it hopes to leverage its strong presence in the automotive infotainment space into advanced driver assistance systems), Internet of Things (including opportunities in the PC market, VR/AR market, and factory automation) and radio frequency (where mmWave adoption globally, including China, would drive substantial upside).”

Comments