A Tidy Way To Sweep Up Some Profits This Earnings Season

- Vavio.io

- Jul 26, 2022

- 3 min read

It’s that special time of the year when investors wake up giddy with excitement: earnings season. And if you’re looking for a way to profit as US companies release their latest results, we have one strategy to recommend that could help you do exactly that…

What’s the strategy?

Instead of buying shares of a company directly, you can use the stock replacement strategy to buy “deep in the money” call options – options whose “strike price” is $5 to $10 below the stock’s market price. Options are usually cheaper than buying shares directly (which frees up your cash for other investments), and the prices of deep in the money ones tend to move in sync with that of the stock itself.

Here’s an example: if you bought 100 shares of MadeUpCo for $50 each, that’d set you back $5,000, assuming no fees. If MadeUpCo’s stock then rose to $55, you’d be up $500, or 10%. But if you bought a deep in the money MadeUpCo call option with a strike price of $40 for, say, $12, the value of your contract is $1,200 ($12 x 100 shares per options contract). If there’s a 1:1 relationship between the underlying stock price and the option’s price – a.k.a. the “delta” – then the $5 increase in the stock price would push up the option’s value by $5, bringing the total value of your investment to $1,700 ($1,200 + $5*100). That’s a 42% return versus 10% from owning the stock directly, which is part of what makes this strategy attractive.

Why use the stock replacement strategy?

Macroeconomic factors like inflation, interest rates, and geopolitics have been the biggest drivers of stock markets this year. You can see that in the relatively strong correlations in the S&P 500: stocks have been moving up and down in sync. And that’s likely to continue: the forward-looking three-month implied correlation for S&P 500 stocks is elevated – close to its all-time high. That indicates investors haven’t adjusted their portfolios to account for idiosyncratic single-stock moves around earnings updates. And that means there’s potential for a short-term rally in stocks.

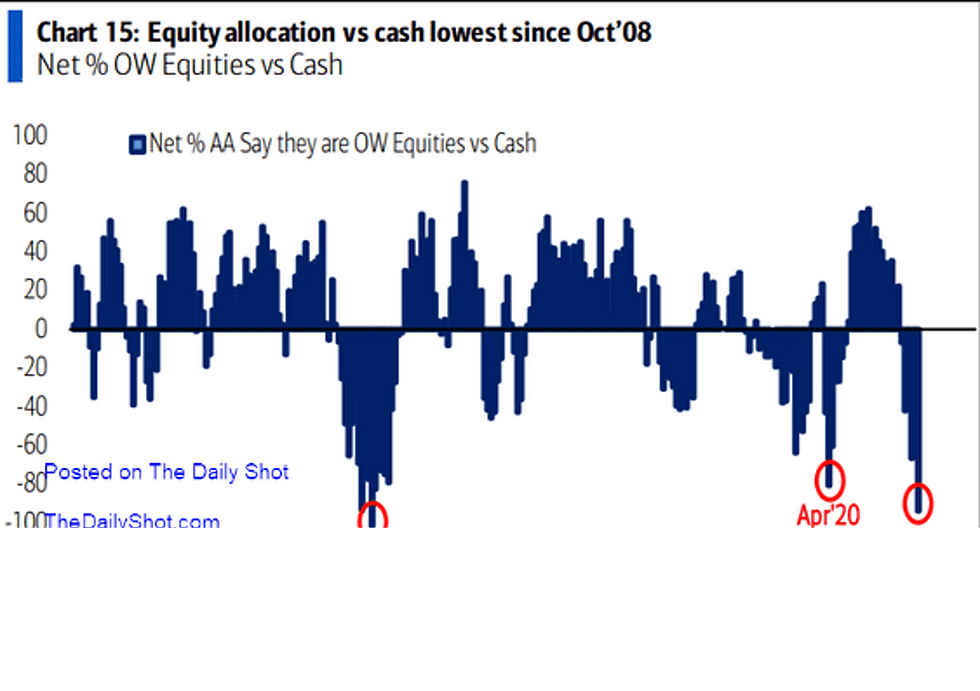

To be fair, there are factors working against buying call options right now – high volatility can make them more expensive, for one – but at least one more factor suggests that now’s a good time for options-based strategies. And that’s this: investors are unusually fearful right now; their allocation to stocks versus cash is at its lowest since October 2008.

Source: Bank of America, The Daily Shot.

So what’s the opportunity here?

Luckily for us, Goldman Sachs has screened for companies that could be well-suited for the stock replacement strategy this earnings season. The investment bank focused on stocks with liquid options (they can be bought and sold more easily), ones that have buy ratings and higher earnings estimates from the investment bank’s analysts versus rival banks, and ones that have underperformed the S&P 500’s 7% drop in the past three months.

Source: Goldman Sachs.

Note that Goldman excluded energy and materials stocks, whose performance primarily swings with commodity prices. Some of the biggest names yet to report earnings are Amazon, Atlassian, and Shake Shack.

For context on how to think through assessing these sorts of opportunities, let’s look at Atlassian, based on Goldman’s analysis. The firm recently upgraded Atlassian’s shares to buy from neutral, citing a “pivotal moment” in its cloud transition which’ll accelerate its growth. Goldman says Atlassian will have earned 15% more in second-quarter profit than other investors expect, and 9% more over the next four quarters.

According to Goldman’s calculations, the share price is apt to swing 12% in either direction when the company reports earnings – and likely higher if the bank’s bullish view on Atlassian’s earnings proves true. And investor expectations are more negative than positive at the moment, as measured by “options skew”, the proportion of options being used to bet on a lower future share price versus a higher one.

Finally, the stock has underperformed the S&P 500 by 16% over the past three months, leading Goldman to recommend investors buy the Aug-22 $192.50 calls, recently offered at $17.30 (9%, stock $191.59). The key risk to be aware of is that call option buyers risk losing the money paid for the option – a.k.a. the option premium – if the stock ends up below the strike price when the option expires.

Comments