Breaking: The BoE Throws The Whole Thing Into Reverse

- Vavio.io

- Sep 28, 2022

- 3 min read

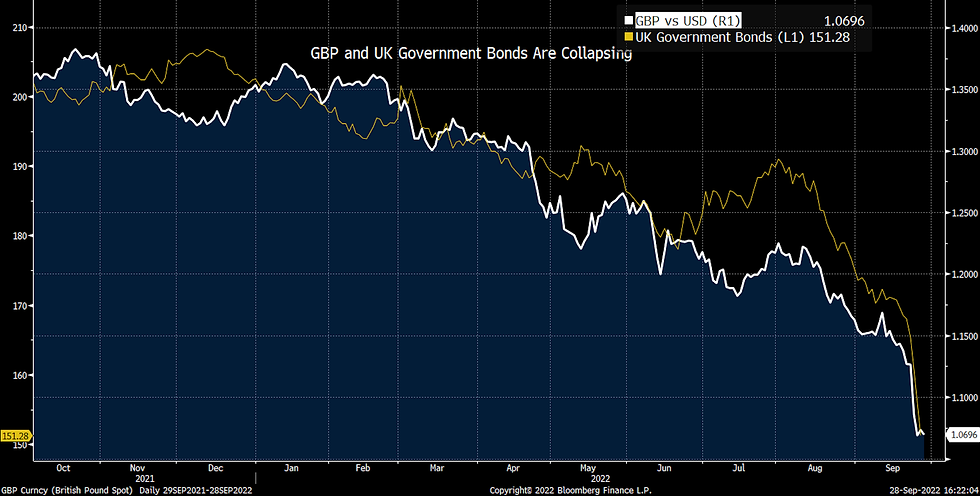

The Bank of England (BoE) is taking steps to flood markets with cash while inflation is already at record high. What could go wrong…

What just happened?

The UK’s central bank announced today that in order to restore the stability of the UK financial system, which has been rattled by the new government’s sweeping tax-relief package, it’ll temporarily buy long-term bonds “on whatever scale is necessary”.

Why did it do that?

Officially: to restore order in the UK bond market. Unofficially: to avert a catastrophe for the UK’s pension funds and property sector.

When UK stocks and bonds both collapse at the same time, pension funds – which hold truckloads of both assets – face huge potential losses. And if they can’t meet their margin calls (since they do tend to buy those assets on leverage, their brokers will call up and make sure those massive money houses have got enough collateral to cover for the potential losses), well, they go broke.

What’s more, mortgage rates are linked to long-term bonds. By effectively capping their rise, the BoE can attempt to prevent a massive shock to homeowners’ bottom lines, and avoid the potential default of banks, homebuilders, and other big players involved in the sector.

That’s where we are: the UK government is calling in the central bank to stop a historic selloff in bonds, believing it to be the only way to save people’s pensions, and avoid a full collapse of the UK financial system. You’re probably going to hear some shouting about how independent the Bank of England actually is, but, let’s agree, that’s shouting for another day…

So what happens next?

It’s a thrill a minute right now. Less than a week ago, the BoE announced another 0.5 percentage point interest rate hike, the seventh in an aggressive string of hikes aimed at taming the country’s sky-high inflation. And now this. If you find it confusing that the Bank is now planning to buy up piles of long-dated bonds to prevent long-term rates from rising, you’re not the only one. What can I tell you? Maybe they’re simply trying to buy time while they figure out how to solve this mess.

The big problem with what’s happening is this: while it may temporarily calm investors, the Bank’s latest measures might also increase the risk that things will go very wrong.

First, they could make inflationary pressures even worse, which would hurt not just the economy, but also UK assets. Ironically, those higher inflation pressures would call for… even higher interest rates. Confusing, yes: I told you.

Second, they may push the British pound, which is already near all-time lows, even lower. With the BoE intervening, long-term yields won’t reach a level that’s high enough to adequately compensate foreign investors for the increased risk of holding UK bonds (and with such unpredictable policy measures, the risks certainly have increased). And that makes investing in UK debt a pretty unattractive proposition. So, foreign investors will probably continue selling off their UK assets en masse – essentially, dumping the pound.

Third, these measures could lead investors to test the BoE’s resolve, to see whether the Bank is really willing (or able) to buy up enough long-term bonds to keep those prices from falling. If anyone wants to try their hand at becoming the next George Soros – who famously broke the Bank of England in the ‘90s – now may be the time.

One thing’s for sure: it’s a mess, and it might have to get a lot worse before it gets better. Your best bet is to avoid UK assets altogether, and if you own GBP, it might not be too late to exchange at least some of them for US dollars.

Comments