How To Profit From NFTs (Without Buying NFTs)

- Vavio.io

- Oct 18, 2022

- 4 min read

The market for non-fungible tokens (NFT) is far from dead. However, you might prefer a risk-free manner to play in this setting. Here are two tactics you can employ:

How is the NFT market still breathing?

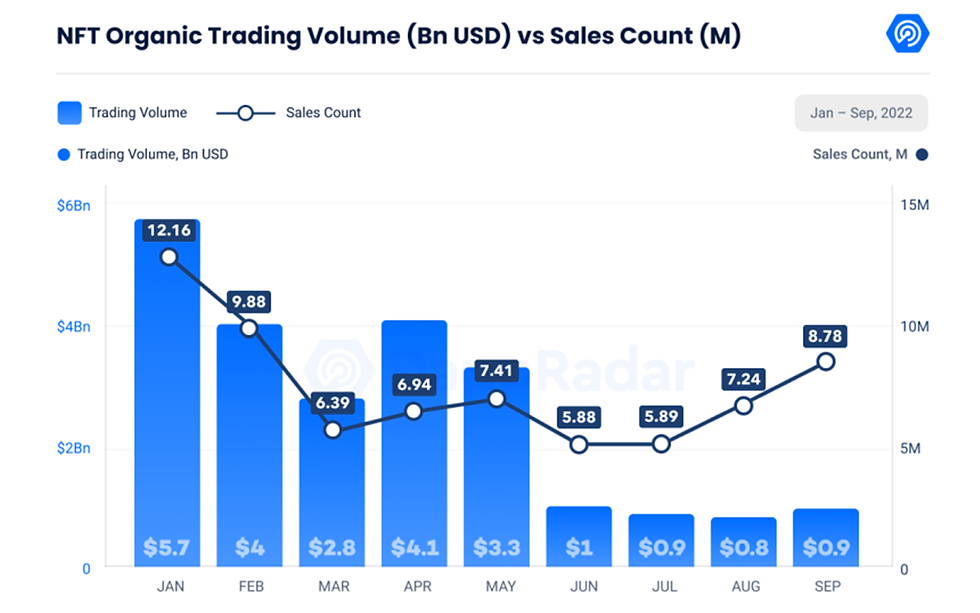

According to DappRadar, the quantity of NFTs exchanged climbed by 8.3% in the third quarter even though their value fell by 67%. From July through September, almost 21.9 million NFTs were traded, representing a $2.75 billion value transaction. It's interesting to note that NFT sales increased by 8.78 million in September, the highest number since February of this year, continuing a trend that began in June. This implies that despite extremely low pricing, the market for investors and collectors is still expanding.

Source: DappRadar.

Blue-chip collections like Bored Ape Yacht Club (BAYC) and CryptoPunks, in contrast to much of the NFT world, have maintained their values very well throughout the bear market. The BAYC floor price, which is the cost of the least expensive Ape in the collection of 10,000, is currently about 75 ethers, up from 59 at the beginning of this year. According to The Block, the floor price for CryptoPunks increased somewhat from 63.7 ethers to 66.6 ethers. However, even in US dollar terms, they have suffered greatly because the price of ether has decreased by around 65% over that time.

Source: The Block.

Here’s how much the top Punks and Apes were fetching last quarter…

Most expensive NFT sales in Q3, 2022. Source: DappRadar.

DappRadar reports that only four Yuga Labs projects—BAYC, CryptoPunks, OtherSide, and Mutant Ape Yacht Club—accounted for 46% of the total NFT sales value in September. In a weak market, investors find relative safety in the most in-demand collections, which is not surprising. That percentage is probably going to decrease when sentiment ultimately improves again as more investors jump in to uncover the next gems in the rough. But let's be honest: it can be challenging to discover the jewels among the millions of NFTs that are available.

Are there easier ways to profit from NFTs?

The majority of us do not have hundreds of ethers laying around to invest in highly sought-after blue-chip projects, and flipping NFTs on the cheap requires a full-time job with little guarantee of a significant return. Here are two different approaches to playing this that both have varied levels of risk.

1. Invest in NFT marketplace tokens:

On NFT marketplaces, traders and collectors buy their goods. Users can mint, buy, and sell NFTs via these decentralized applications (dapps), which directly connect to blockchains like Ethereum. The largest marketplace is Opensea, which brought in over $170 million in fees over the previous six months (gray bar). There is no doubt that the present bear market has hampered business: Opensea only brought in $33 million over the last three months (blue bar), with just $8.8 million of that total coming in the last 30 days (green bar).

Source: DappRadar.

Since Opensea is a privately held business, you cannot make a direct investment in it. But emerging rivals LooksRare and X2Y2 have their own tokens: LOOKS and X2Y2, respectively. They aren't making as much money as Opensea, but they are still collecting large amounts in fees: LooksRare has generated $66 million in the last six months, surpassing both the top DeFi platform on Binance Smart Chain, PancakeSwap, and the well-known cryptocurrency wallet MetaMask (CAKE). Additionally, X2Y2 processed $74 million in NFT sales last month despite having approximately eight times as many customers as LooksRare and earning less in fees overall.

LOOKS tokens operate much like a platform membership incentive scheme: you can receive the tokens as payment for creating, purchasing, or selling NFTs. Additionally, users can stake the tokens to partake in the trading platform's commissions. So, assuming everything else is equal, the demand for LOOKS increases with with their value as more users engage with the site.

You will also receive a portion of the platform's trading fees if you own X2Y2 tokens, however unlike LookRare, X2Y2 does not compensate users for trading NFTs. It contends that token reward programs encourage "wash trading," in which users manipulate the system by exchanging NFTs for money. For precisely that reason, LooksRare has been cracking down on shady transactions since January.

At the time of writing, each LOOKS token was trading on the Bybit platform for roughly 24 cents, giving the total market value of all the LOOKS tokens around $220 million. With each token costing roughly 10 cents on BitGet, X2Y2 has a lesser market cap of about $103 million. Remember that these are extremely risky investments, so if you decide to invest, you might want to take it slowly. LOOKS was selling at more over $5 at the beginning of this year; it is currently 95% below its highs. When it first debuted on BitGet ten months ago, X2Y2 had a similar fall, trading above $2.

2. Buy the tokens of the up-and-coming NFT blockchains

When it comes to NFT collectibles, Ethereum is the industry leader, recently accounting for 90.5% of the total value in the category. Therefore, buying ether would be a simple method to indirectly gain exposure to NFTs; after all, ether is the currency of the major blue-chip projects. People pay fees in ether each time a sale completes or a new NFT is created on Ethereum.

Source: DappRadar.

Want to read more?

Subscribe to evokedigital.wixsite.com to keep reading this exclusive post.