Why Pantera Capital’s CEO Sees A New Dawn For Crypto

- Vavio.io

- Sep 28, 2022

- 4 min read

When you’re the CEO of one of the oldest and biggest crypto funds in the world, people like to know what you think. Dan Morehead runs Pantera Capital, which has been around since 2013 and has $4.5 billion invested across a range of digital assets. This month, he sat down with Real Vision CEO Raoul Pal to share his thoughts on the crypto market – how it might fare in the current economic mess, and where the opportunities could be. Here are the key takeaways…

1. Interest rates will go higher, and inflation isn’t going down any time soon.

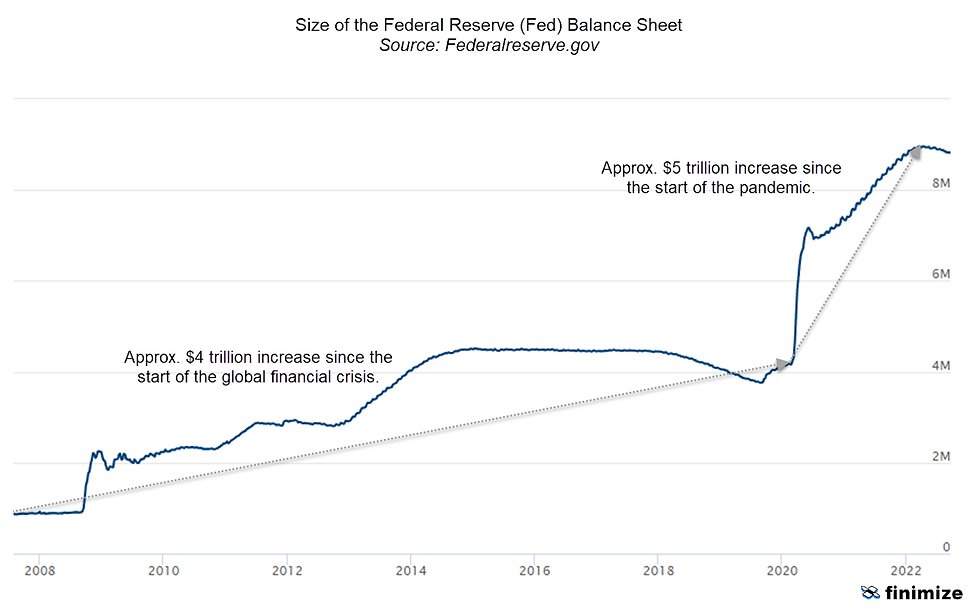

Morehead sees interest rates rising higher than people expect. He says the Federal Reserve (the Fed) kept interest rates too low for too long, and injected far too much liquidity into the market during the pandemic era, buying government bonds and bloating the size of its balance sheet.

Size of the Federal Reserve balance sheet, in millions of dollars. Source: FederalReserve.gov.

All that added liquidity was a tailwind for most investments, but those gains came at a price: they sent the everyday cost of living higher too. And when the Fed finally started raising interest rates and shrinking its balance sheet to fend off inflation, that tailwind quickly turned into a headwind for the crypto, stock, and bond markets. And Morehead thinks inflation, whose effects usually take time to filter through the economy, won’t go down without a lot more interest rate hikes from the Fed.

2. Crypto will do its own thing, regardless of what happens to stocks, bonds, and the economy.

Morehead sees two reasons why crypto is likely to go its own way, breaking off from its recent price synergy with other investments.

First, high interest rates don't directly affect the value of crypto like they do for stocks and bonds. And when investors realize that, they’ll be more likely to see crypto as a better alternative. See, stock and bond prices tend to go down in a world of rising interest rates. That’s because the market cuts today’s value of a stock’s earnings (or a bond’s interest payments) based on certain discount rates. When interest rates go up, so do those discount rates, which brings the asset’s perceived value down. Then, since investors see the values of stocks and bonds being lower, they sell them, which drives down their prices until they become more in line with those values. Crypto has none of that – and I’ve never seen an analyst use interest rates to value them.

Second, Morehead believes digital assets will trade based on their own fundamentals and levels of adoption. Like with Apple (APPL, blue line) or Amazon (AMZN, orange line) back in the day, you can get the same kind of multi-decade disruptive growth opportunity with crypto. Sure, the two stocks have had some short-term correlation with the overall market (S&P 500, gray line) from time to time. But over the past 20 years, they’ve mostly done their own thing.

Apple stock (AAPL, blue line), Amazon (AMZN, orange line), and S&P 500 (SPX, gray line) percentage returns since January 2000. Chart drawn with TradingView.

I’ve also written before about why I think bitcoin could break away from its correlation with stocks here.

3. Bitcoin will lose market share against other projects over time.

Morehead sees bitcoin’s value rising a lot in the long run, but sees its share of the overall crypto market trending downward. When Pantera started out in 2013, the OG crypto was the only game in town. But thanks to smart contract technology, the market has progressed from “simple” bitcoin transactions to complex DeFi, crypto gaming, and NFT transactions on different blockchains. Just like with the internet, more and more use cases will turn up for blockchain.

Morehead is especially interested in DeFi, which proved its worth after centralized finance (CeFi) lending and borrowing platforms Celsius and Voyager filed for bankruptcy. DeFi managed to hold up well, with everything programmed into the blockchain for all to see. With CeFi, people didn’t realize something was “off” until it was too late.

4. Buying in bear markets is your best opportunity to make good money in crypto.

Pantera’s seen its share of crypto boom and bust cycles in the few years since its founding. During the booms, investors have flocked toward it, with the fund seeing massive inflows when prices and market sentiment were peaking. During the busts (like the one we’re in now) investors have held back, fearful of more downside. As you’d expect, the clients who have made the most money with Pantera invested during the busts.

5. Crypto only has just one major risk left – regulation.

There was a long list of risks associated with investing in crypto during Pantera’s early days, but most of them no longer apply today. There weren’t any custodians to safeguard digital assets for big investors for a long time, for example, and now there are many institutional-grade providers – including Fidelity and other big names – doing just that. There were also questions about whether blockchain code would function effectively, but bitcoin hasn’t broken down or gone offline once since its first transaction in January 2009. Still, there’s one potential risk that hasn’t yet been fully resolved, especially in the US: the future of regulation for the industry. And there’s no telling when there will be clarity on that front.

What’s the opportunity here?

Morehead says crypto has likely already bottomed, and now is as good a time as any to invest. He sees crypto becoming a major alternative asset class in the coming years, with institutional investors allocating up to 8% of their portfolio into it – and that’s a lot of capital to boost prices in the long run. If you’re sold on Morehead’s views, your next step is to build a digital asset portfolio that could potentially stand the test of time and profit from the uplift. I’ve explained how you can do that over here.

Comments