Daily Brief: The UK Says “Thanks, But No Thanks" To Russia

- Vavio.io

- Aug 25, 2022

- 3 min read

Data out on Wednesday showed that UK imports from Russia hit a record low in June.

What does this mean?

The UK has imposed restrictions on over 96% of goods imported from Russia since it invaded Ukraine in February, and most of the businesses whose products weren’t sanctioned have probably stopped dealing with the country anyway. That might be why Russian imports into the UK dropped to £33 million ($39 million) in June – 96% less than the same time last year. A big part of that was down to the fact that the UK didn’t buy a drop of fuel off the country, even though Russia was its biggest supplier of refined oil before the war. Instead, Britain’s been upping imports from other oil-producing countries – think Norway and Qatar – to make up the difference.

Why should I care?

The bigger picture: Discounts galore.

The European Union hasn’t been quite so successful: the region’s imports were up 43% in June, given just how dependent it is on the country’s energy supplies. Russia, for its part, is well aware that Europe would drop it in a hot second if it could, which might be why it’s reportedly in discussions to give several Asian countries up to 30% off long-term oil contracts.

Zooming out: Russia dodges a bullet.

Economists were expecting Russia to have a meltdown following all the sanctions, but its high-priced energy has kept that from happening. In fact, the country’s “current account surplus” – that is, the value of the goods it exports minus the value of the goods it imports – hit a record high in the first seven months of the year. That’s only good news for the economy, which might be why the Russian government is expecting the economy to shrink just 4% this year, rather than the 12% it was forecasting a few months ago.

Keep reading for our next story...

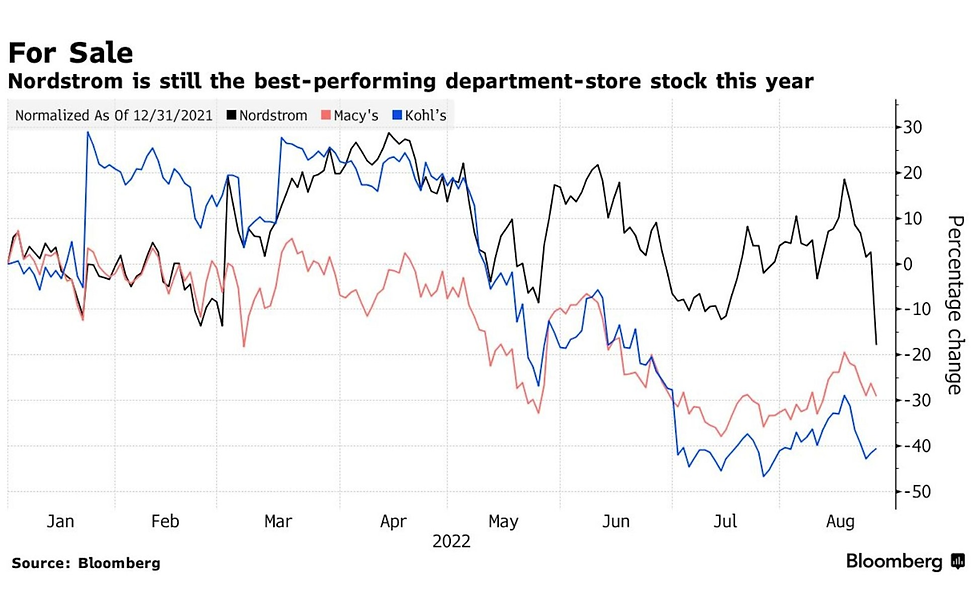

Macy’s And Nordstrom Can’t Win The Mall

US department stores Macy’s and Nordstrom both cut their revenue and profit outlooks earlier this week.

What does this mean?

Macy’s and Nordstrom specialize in nice-to-haves like clothing and homeware, so they were always going to find it tricky to appeal to a belt-tightened shopper. But the shift in spending habits has happened faster than anyone expected, and the stock they built up since the pandemic has become nearly impossible to shift. Keep in mind too that both retailers said footfall in their stores had dropped off, which means they’ll probably have to offer heavy discounts to clear their shelves. And even though they’re tweaking the amount of stock they order in going forward, it seems like it’s too little, too late: both cut their full-year sales and profit outlook.

Why should I care?

Zooming in: Macy’s Plan B.

Macy’s already has a couple ways it’s planning to try to bring shoppers into the fold. For one thing, it’s been opening smaller stores in more populated areas to make it more convenient than a day trip to a mall. And for another, it’s struck a partnership with Toys R Us to bring toys and games to hundreds of Macy’s locations just in time for the holidays.

The bigger picture: Malls are not a priority.

Macy’s did say that spending at its Bloomingdale stores – where the average household income of its customers is over $250,000 – continued at a healthy pace, but that those with customers on a lower typical income saw a slowdown. After all, lower-income shoppers spend a bigger proportion of their salaries on food and energy, which are only becoming less affordable: new data has shown that a record one in six US households have fallen behind on their utility bills. So if Macy’s and Nordstrom think those customers are going to splurge on a Nutribullet, they have another thing coming.

Comments